How to protect your Finance and Banking DevOps data

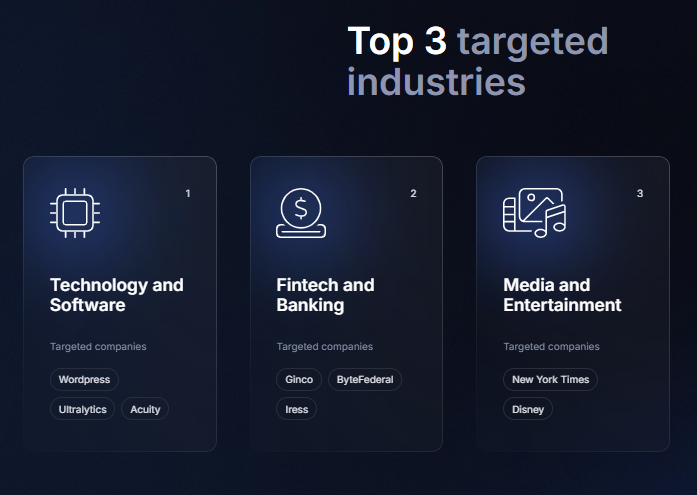

Fintech and banking ranked among the top three most targeted industries in 2024, according to the CISO’s guide to DevOps threats.

Real-world incidents underscore this trend: Byte Federal, the leading Bitcoin ATM operator in the U.S., suffered a breach linked to a GitLab vulnerability. Meanwhile, financial software provider Iress and crypto wallet company Ginco were both targeted by threat actors exploiting GitHub repositories.

Source: 2024 DevOps Threats Unwrapped

Thus, security is necessary as financial companies deal with sensitive information that cannot be open to any risk. Did you know that, according to the Financial Services Edition, 95% of financial institutions reported that they experienced an increase in attacks, and 61% of security leaders and practitioners working for financial services say that secret management is their main challenge in DevOps?

Since the stakes are high, mistakes can lead to dreadful consequences. Things to look out for include compliance with regulatory requirements, data breaches, human errors, and current trends around cybersecurity in the financial sector. With this article, you will find out how to balance agility with security and implement effective data protection strategies to keep your financial data safe and your customers satisfied!

Benefits of DevOps in banking and finance

More and more organizations across the finance sector adopt DevOps, to be precise, over 80% already implemented DevOps and take advantage of the benefits this brings.

These are some of the key benefits of DevOps in the financial sector:

| Advantage | Explanation |

| Faster time-to-market | The development lifecycle is streamlined thanks to automation and continuous delivery. This allows new features and updates to be released much faster. |

| Efficiency and cost savings | Repetitive tasks like testing and deployment are automated. Therefore, manual work is reduced, operational costs are lowered, and IT teams can focus on primary objectives. |

| Better security and compliance | Security is implemented from the beginning (shift-left security), and vulnerabilities get detected quicker. This simplifies compliance efforts in terms of regulatory frameworks. |

| Operational reliability | Things like CI/CD allow for more frequent and reliable releases with no downtime, which is crucial for uninterrupted financial operations and quick bug fixes. |

| Potential for scalability | Scalable infrastructure and workflows that grow with the institution’s needs make it easier to adapt to customer and market demands. |

| Easier collaboration | Closer collaboration between development, operations, and security teams breaks barriers and improves communication across key departments. |

| Improved customer satisfaction | Faster, more secure, and reliable digital services lead to greater satisfaction for banking customers. Additionally, continuous improvement encourages teams to come up with cutting-edge solutions, further supporting shareholder satisfaction. |

Why should data security be taken seriously in such industries?

The financial sector processes great volumes of sensitive data on a daily basis. These range from customer records to transaction logs. Just a single breach can result in financial losses, reputational damage, and even legal consequences. So, why should DevOps financial data security be a top priority in this sector?

Challenges with securing DevOps financial data

For starters, there are still legacy systems in place. A study conducted by the Financial Conduct Authority (FCA) states that 92% of financial institutions in the UK still rely on legacy technology. Only a mere 8% reported that there is no technological debt in their organizations. This issue leads to difficult integration and modernization of systems. Many companies can be overwhelmed by the amount of new tools, technologies, and procedures that need to be implemented.

Moreover, taking everything into account, the cost of implementing secure DevOps practices can be large, especially when you add the requirements for regulatory compliance into the mix.

Compliance

Financial institutions are especially required to comply with security and data protection regulations as well as general (and local) banking laws. Due to the sensitive nature of data stored and processed by financial firms – from personal information to transaction logs – failures to comply can result in fines or penalties, reputational damage, and operational restrictions. Quick deployments and changing configurations facilitated by DevOps necessitate even more emphasis on working towards continuous compliance.

Security regulatory frameworks for the financial industry include GDPR, SOC 2, ISO 27001, PCI DSS, NIS2 (when it comes to operating in Europe), etc..

Be aware that vendors that handle customer data (usually in the cloud) collaborating with these financial institutions, should be SOC 2 compliant as well to guarantee the security of sensitive financial data.

As you may know, when it comes to cloud environments, security duties are shared between the service provider and the customer (in our case, a financial institution). Therefore, it is important to understand the areas of responsibility and address any gaps. Inadequate security or a lack of understanding of the shared responsibility model can lead to vulnerabilities. For example, a financial company may think that the provider can facilitate restore processes for accidentally deleted data, where, in fact, it is the company’s responsibility to keep backup copies of data with capabilities to recover.

📌 GitHub Shared Responsibility Model

📌 Azure DevOps Shared Responsibility Model

📌 Atlassian Shared Responsibility Model

📌 GitLab Shared Responsibility Model

Human error

Did you know that human error contributed to 95% of data breaches in 2024? Seems like a scary statistic, but it is the reality of today’s cybersecurity. Human error could leave “an opening” for attackers to exploit using ransomware, man-made mistakes can result in issues leading to outages of systems or simply downtime, not to mention accidental and intentional deletions. Make sure to look out for:

- Human oversight of automated processes

- Pushing faulty code into production

- Exposing secrets or sensitive information

- Deleting data that may end up being useful

- Disruptions of operations, downtime or outages

- Compliance violations

- Customer trust

Outages

Service disruptions may seem outside the scope of your ability to manoeuvre around them. However, it is actually simpler than you might think. Frequent and complete backups of data with flexible recovery capabilities allow you to get back to operational norm in no time. Therefore, always keep in mind that misconfigurations, failures in code, or external dependencies have the potential to interrupt banking services. These can range from customer support to online transactions. It is necessary to implement a safety net in the form of a complete and reliable backup and disaster recovery strategy.

Ransomware

Due to the expanded attack surface that DevOps brings into the financial sector (more connected services and tools, frequent changes, etc.) threat actors aim to spot vulnerabilities that can be exploited for their gain. If such a ransomware attack were to end up being successful for the attacker, an organization’s operations may come to a complete halt, and the attacker will demand a ransom for the stolen assets. This will lead to financial as well as reputational losses.

Best practices to protect your finance and banking DevOps data

Securing sensitive data, especially in the financial sector, requires proactive and layered security strategies. Careful management of security procedures facilitates long-term security and business continuity, but it must be closely monitored and continuously improved.

Adopt DevSecOps

Development, security, and operations – “DevSecOps” is a merger and an evolution of “DevOps” and security. Here, you should make sure to shift security left, and integrate security from the very beginning of any development processes. Include automated security testing, vulnerability scans, static/dynamic analysis – all at the start of the CI/CD pipeline. Why is this beneficial? Well, risks and issues are found before making it to production and can be dealt with securely.

Proper access control

Make sure to implement role-based access control (RBAC). This helps to guarantee that users only get access to what they truly need. Moreover, to secure the authentication process, multi-factor authentication (MFA) is a must-have. It strengthens the verification of user identity and keeps out unwanted individuals.

Last but not least, financial firms should adopt the principle of least privilege (PoLP) to further minimize risks associated with breaching access. With the principle of least privilege, you guarantee that users, apps or even systems only get the minimum access that is required for the specific tasks or functions. These are crucial to minimize risk and can be an entry point for attackers.

Regular security checks and assessments

Another important security aspect is continuous assessments of security. These include code audits, penetration testing, as well as third-party risk evaluations. While this is good for spotting things that automated tools may have missed, it is beneficial for compliance with regulatory requirements as you keep verifying if security procedures are still effective. It is necessary to keep your security strategies updated according to the relevant evolving threats and compliance standards.

Implement monitoring and threat detection

This step helps you to get a clear overview of all processes and potential issues within your financial institution. Comprehensive monitoring, logging, and advanced, real-time threat detection are a great addition to your financial DevOps security arsenal. Make sure to cover analytics tools along with automated alerting to get you informed properly and in a timely manner. This way, teams can respond to and deal with security scenarios or breaches more effectively.

Boost the strength of your infrastructure

Try implementing network segmentation and micro segmentation – this limits the potential blast radius of a security breach. To be specific, isolating critical environments and systems prevents attackers from moving between different areas of your ecosystems and further exploiting compromised tools. Make sure to implement strong access controls, firewalls and pre-built configurations in the software that will compartmentalize data.

Backup and DR strategy

Make sure to implement a dedicated solution for backups and disaster recovery (DR). These two are interconnected and are your safety net in any recovery efforts, while also supporting your compliance. Complete backup vendors should offer you:

- Different, customizable plans to accommodate your needs,

- Full data and metadata coverage,

- Regular, frequent, and automated backups,

- Encryption at rest and in transit, with your own key pair,

- Unlimited retention

- Adherence to the 3-2-1 backup rule,

- Data replication.

As for recovery capabilities, a complete solution will accommodate any scenario according to the shared responsibility and your specific RPO and RTO requirements. Main restore capabilities include:

- Full data recovery,

- Cross-over recovery to another platform,

- Point-in-time restore to get data from specific time periods,

- Granular restore that allows you to bring back specific data elements you may need.

How GitProtect supports data protection for finance and banking DevOps data

GitProtect could be a sensible addition to the data protection strategies of any financial institution. Given the necessity of backup and disaster recovery strategies in today’s world of banking, companies and their clients both benefit from strong security.

“GitProtect.io came to give more tranquility and security in the backup of our GitHub repositories.“ — Andre Esteves, Senior Security Analyst at Zoop, one of the biggest fintech companies in Latin America

GitProtect is here to help institutions with policy-based automated backups, along with a scheduler to eliminate human error and introduce consistent all-around protection. Unlimited retention, coupled with replication across many storage instances and the possibility of different deployment methods (Cloud/on-premise), will support the organization’s compliance efforts and boosts its cyber defenses.

True disaster recovery

What is more, with GitProtect, organizations get true disaster recovery in the form of point-in-time, and granular restores, along with cross-platform migrations and full data recovery. Thus, organizations can quickly recover from accidental deletions, service outages, or platform issues.

“When we need to restore a repository, GitProtect brings speed, convenience and security to this process,“ — Andre Esteves, Senior Security Analyst at Zoop (read the full Case Study)

High security standards

Moreover, security is a priority for GitProtect as the vendor is compliant with a range of security certifications, including SOC 2 Type II and ISO 27001. To further drive security forward, GitProtect offers three levels of AES encryption, custom keys, and zero-knowledge architecture. This guarantees that banking institutions get exclusive control over their data encryption. Other advantages include SSO and SAML integration with many identity providers and permission settings to apply the principle of least privilege.

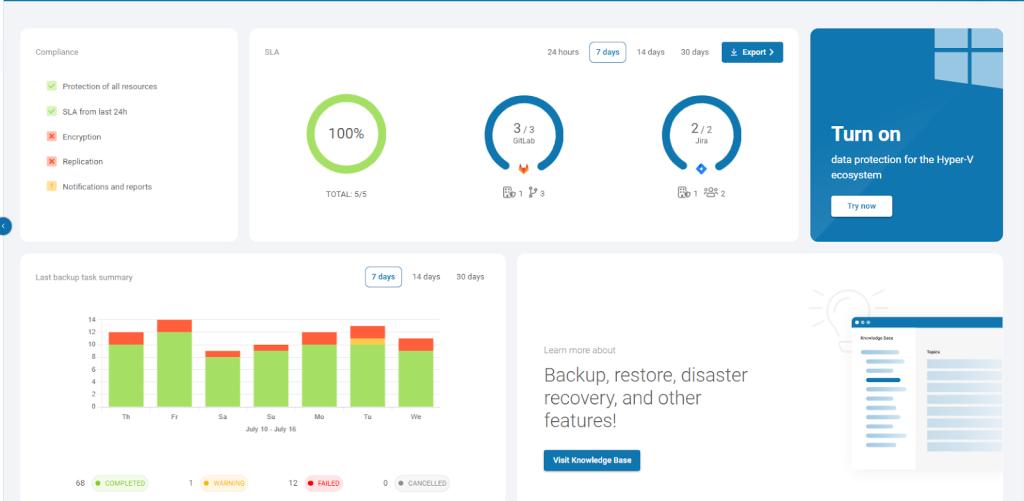

Source: GitProtect’s dashboard

All of this in a single intuitive interface with monitoring capabilities, detailed logs, reports, dashboards, Slack, and email alerts (can be configured) as well as SLA and compliance reports to support any audits.

Takeaway

The financial sector is largely built on trust, compliance, transparency, and the performance of systems in place. With institutions implementing DevOps for quicker deployments or more innovative services in mind, one thing remains true: security must evolve with company development.

This is not just about compliance; we are talking about the security and the future of digital banking. Therefore, moving on from legacy systems, adhering to shared responsibility models, and implementing security measures like backup and DR solutions are inevitable and crucial steps towards reliable data protection in the financial and banking industry.

[FREE TRIAL] Ensure compliant DevOps backup and recovery of your fintech and banking data with a 14-day trial 🚀

[CUSTOM DEMO] Let’s talk about how backup & DR software for DevOps can help you mitigate the risks in one of the most targeted industries